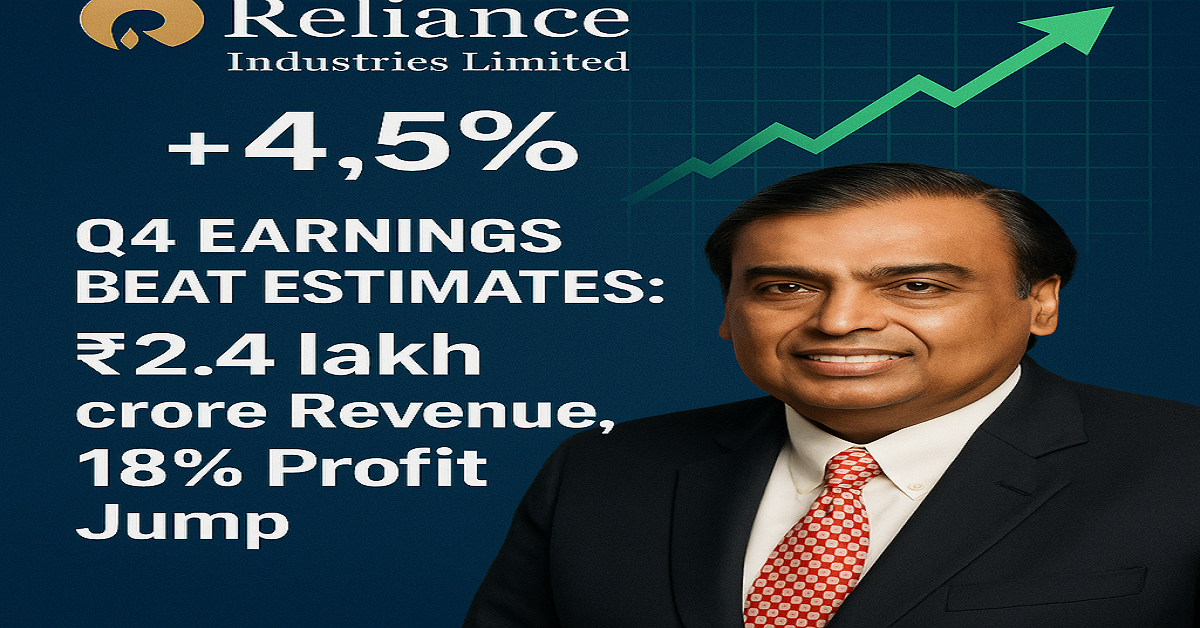

A Blockbuster Quarter for Reliance

Reliance Industries Limited (RIL) just proved—once again—why it’s India’s most formidable corporate powerhouse.

On April 22, 2024, the Mukesh Ambani-led conglomerate reported better-than-expected Q4 earnings, sending its stock soaring by 4.5% in a single trading session. With revenue crossing ₹2.4 lakh crore ($29 billion) and net profit jumping 18% YoY, analysts and investors are doubling down on their bullish bets.

But what’s driving this optimism? Is it just short-term euphoria, or does Reliance have a long-term growth story that justifies the hype?

In this deep dive, we’ll break down:

✅ Key highlights from Reliance’s Q4 results

✅ Why top brokerages are raising price targets

✅ The hidden growth engines beyond Jio and Retail

✅ What investors should watch in 2024-25

Let’s unpack the numbers behind the rally.

Reliance Q4 Results: The Big Numbers

1. Revenue & Profit Beat Estimates

- Revenue: ₹2.4 lakh crore (vs. ₹2.2 lakh crore expected)

- Net Profit: ₹21,327 crore (up 18% YoY)

- EBITDA: ₹42,982 crore (up 16% YoY)

Why it matters: This marks Reliance’s highest-ever quarterly revenue, fueled by strong performances in oil-to-chemicals (O2C), Jio, and Retail.

2. Jio’s Stellar Growth

- ARPU (Average Revenue Per User): ₹182 (up 2.3% QoQ)

- Subscriber Base: 481 million (adding 11 million new users)

- 5G Rollout: Now covers 85% of India

Expert Insight:

“Jio’s 5G monetization is just beginning. As data consumption grows, ARPU could cross ₹200 by FY25.”

— Sanjay Chawla, Telecom Analyst, JM Financial

3. Retail’s Unstoppable Expansion

- Revenue: ₹83,063 crore (up 24% YoY)

- Stores Added: 1,500+ new stores in FY24

- Digital Push: Ajio and JioMart scaling rapidly

Real-Life Example:

Reliance Retail’s “Store of the Future” in Mumbai uses AI-powered inventory tracking, reducing stockouts by 30%.

Why Brokerages Are Upgrading Reliance

1. Morgan Stanley: “Overweight”

- Price Target: ₹3,046 (15% upside)

- Key Reason: “Jio’s 5G and Retail’s omnichannel strategy will drive 20% EPS growth.”

2. Goldman Sachs: “Buy”

- Price Target: ₹3,200

- Key Reason: “O2C margins improving; green energy biz could be next growth trigger.”

3. CLSA: “Outperform”

- Price Target: ₹2,925

- Key Reason: “Retail and Jio will contribute 60% of EBITDA by FY26.”

The Hidden Growth Engines

1. Green Energy Bet

- ₹75,000 crore investment in solar, batteries, and hydrogen

- Giga Factories: Coming up in Gujarat

2. Financial Services (Jio Financial)

- Market Cap: Already ₹2.1 lakh crore

- Plans: Insurance, lending, and wealth management

3. New Commerce (JioMart + WhatsApp Integration)

- Goal: 10 million kirana stores digitized by 2025

Risks & Challenges

- Oil Price Volatility (impacts O2C margins)

- Regulatory Scrutiny (especially in telecom)

- Competition (Airtel, Tata, Amazon)

Final Verdict: Should You Invest?

✅ Short-Term: Momentum is strong post-Q4.

✅ Long-Term: Diversified biz makes it a solid bet.

⚠️ Watch For: 5G monetization, retail margins, and green energy progress.

What’s Next?

Reliance’s AGM in August could reveal new mega-plans. Stay tuned!