AMD share price Climbs Steadily on Surge of Optimism

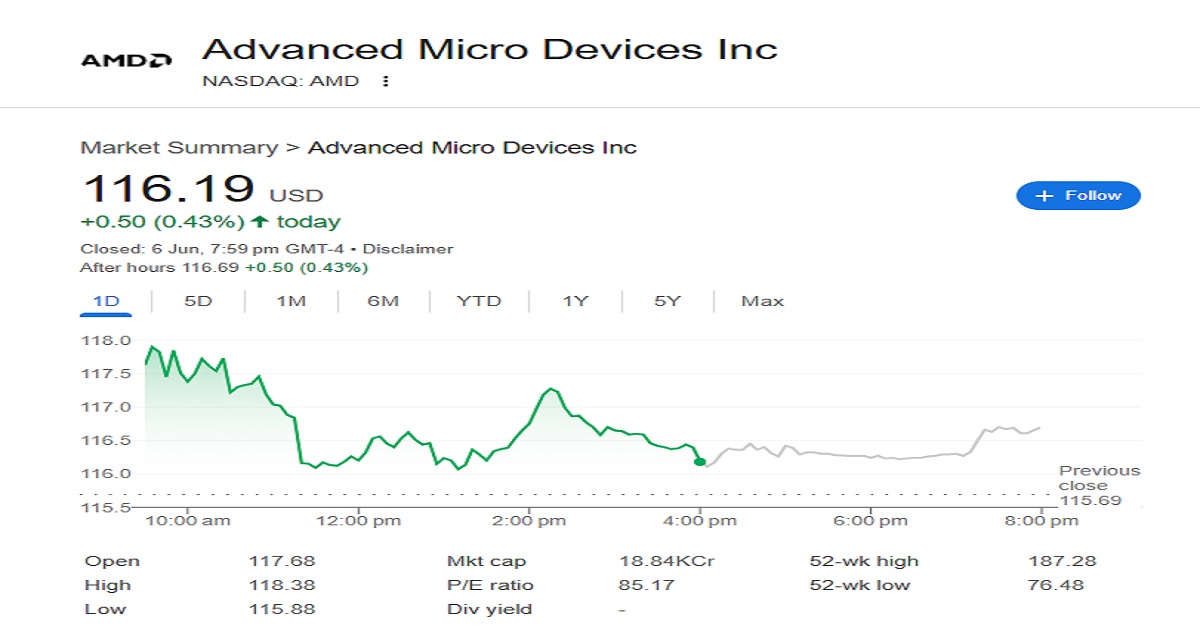

In the bustling nexus of Silicon Valley, Advanced Micro Devices Inc. (Nasdaq: AMD) emerged as a formidable gainer in today’s trading carousel, with its stock catapulting to $117.73 as of 19:54 GMT+5:30. This ascent, amounting to +2.04 USD or a +1.76% uplift, underscores a potent resurgence in investor zeal.

This singular upswing is no isolated spark—it’s a continuation of AMD’s increasingly luminous trajectory. Over the last quintet of trading days, the stock has galloped forward by a noteworthy +5.97%, with a meteoric +16.81% jump recorded across the preceding lunar cycle. These figures sketch a portrait not merely of bullish sentiment, but of unwavering institutional and retail conviction in the semiconductor titan’s strategic cadence.

The stock’s antecedent closing threshold stood at $115.69, serving now as a springboard from which AMD vaulted with evident vigor. This escalation mirrors broader market optimism and possibly hints at anticipated developments—technological, fiscal, or both—that continue to galvanize trader enthusiasm.

Investors appear to be orchestrating their positions with an eye on long-term payoff, perceiving AMD not as a fleeting spark but as a persistent flame within the competitive lattice of chip manufacturing. Whether this performance crescendo signals a more enduring rally remains tethered to forthcoming earnings, innovation pipelines, and sector-wide volatility.

But for today, AMD doesn’t just participate in the market conversation—it commands it.

In the grand tapestry of financial performance, AMD’s recent journey reveals a tale woven with nuanced intricacies and temporal contrasts. Zooming out beyond the immediacy of daily market rhythms, the semiconductor sovereign exhibits a variegated mosaic of returns.

Within the past six lunar cycles, Advanced Micro Devices Inc. has seen its stock valuation ebb by an uncompromising -16.82%, mirroring a tempered investor sentiment amid evolving sectoral headwinds. The trajectory for the calendar year thus far remains subdued, registering a marginal descent of -3.76%, AMD share price while the trailing twelve months have carved out a steeper trough, plunging -28.87%, underscoring medium-term vulnerability.

Yet, this temporal gloom does not eclipse the luminescence of AMD’s legacy. Zooming out to a five-year canvas, the enterprise has bestowed a resplendent +122.10% ascent upon long-standing stakeholders—an unequivocal testament to its engineering ingenuity and strategic foresight. When framed against the full expanse of its public market existence, AMD’s odyssey defies gravity—catapulting an astronomical +25,580% (25.58K%)—a figure not merely numeric, but emblematic of technological transcendence.

A cornerstone in the realm of silicon wizardry, AMD commands reverence across CPUs, GPUs, and increasingly within the hotbed of artificial intelligence accelerators.AMD share price Its stock movements resonate like seismic waves through the corridors of global tech finance, often seen as a bellwether for innovation’s pulse.

Today’s trading tableau unfolded with theatrical unpredictability—the share price danced between peaks and troughs, reflecting not just speculative energy but deep investor recalibration. Yet as the closing bell echoed, AMD ascended with conviction, ending the session on a resurgent note.

Looking ahead, market cognoscenti remain sharply attuned to several critical undercurrents: the global appetite for semiconductors, AMD’s continued evolution in next-gen data architectures, the chessboard of competition, and the sweeping gusts of macroeconomic currents. These forces, converging and diverging, will ultimately sculpt the trajectory of AMD’s stock in the epochs to come.