The US stock market rebounded strongly on June 16, 2025, powered by gains in tech stocks and growing investor optimism. The major indices finished higher across the board, reflecting a dramatic reversal from last week’s sell-off as geopolitical tensions cooled and oil prices fell. We’re seeing a remarkable comeback that underscores the ongoing resilience of US markets, even amid persistent uncertainty and a delicate policy backdrop.

🔹 Market Summary: Tech Leads The Rebound 🔹

All major US indices closed higher in strong momentum:

- The Dow Jones Industrial Average jumped roughly +1.1% (410–426 points), closing near 42,662.

- The S&P 500 followed with a +1.1% rally, closing close to 6,045.

- The Nasdaq Composite led the way with +1.3–1.6% gains, closing at 19,725 — reflecting ongoing enthusiasm for technology and growth stocks.

The intraday range for the Dow fell between 42,300 and 42,720, while the S&P 500 traded from 6,004 to 6,050. The Nasdaq’s range spanned 19,571 to 19,717.

🔹 Key Market Drivers 🔹

1. Rising Investor Optimism amid De-escalating Middle Eastern Tensions

One major contributor to the rally was growing confidence following signals of de-escalation in the conflicts between Israel and Iran. Last week’s escalation had stoked worries of a potential spillover, putting pressure on markets and fueling a rush toward safety. Currently, Iran’s open diplomatic signals and a containment policy by both Iran and Israel appear to ease those worries. Furthermore, crude oil prices fell from their highs, with Brent down toward $71–$72 per barrel and WTI near $71.87, adding a further boost to market sentiment.

2. Fed’s Policy Outlook Grabbing Investor Attention

All eyes are now trained on the Federal Reserve meeting on Wednesday. Market participants do not expect a rate cut this meeting, but the Fed’s forward guidance under Jerome Powell’s leadership will be crucial for understanding policy direction. Currently, futures are pricing in a 0.25% rate cut by September with a 56% probability, reflecting growing optimism that policy may ease in the future. Our view is that the Fed is following a cautious path, attempting to balance its inflation-fight with financial stability — a delicate policy context that underpins current market movements.

3. Sector-Specific Moves Lift Market Higher

Some stocks stood out for their strong performance, fueling the rally:

- Nvidia (+2.9%) — continued its strong upward momentum amid growing enthusiasm for its role in advancing Artificial Intelligence technologies.

- Intel (+3.6%) — rebounded alongside its chip peers following a strong earnings outlook.

- Amazon, Microsoft, JPMorgan, and Goldman Sachs supported the upward momentum.

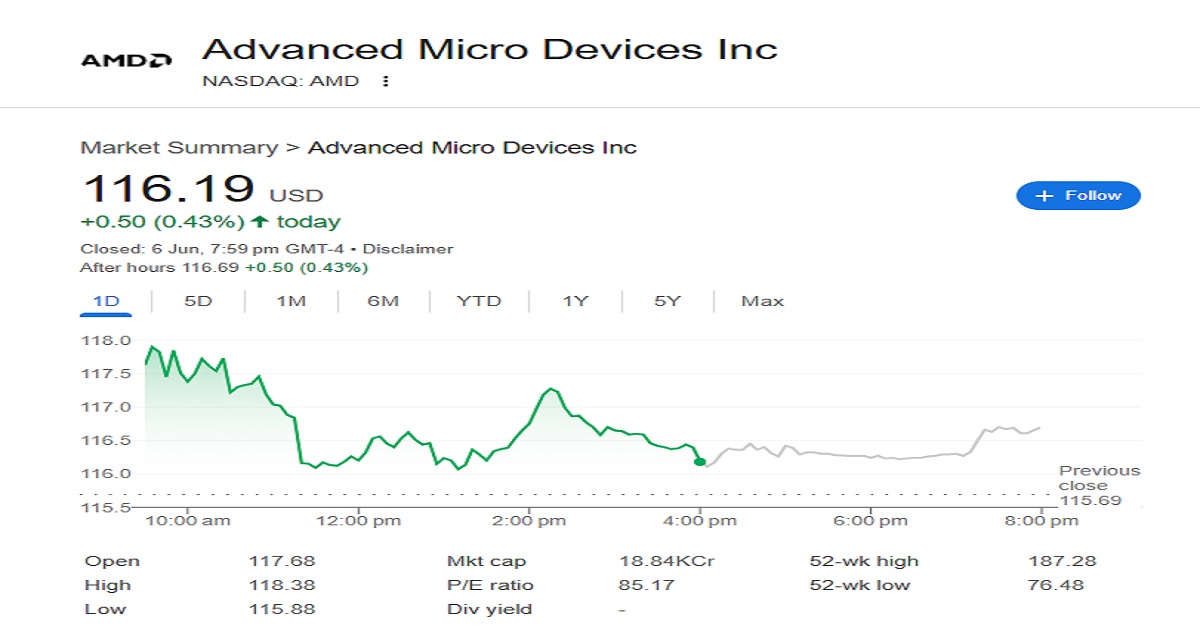

- Advanced Micro Devices (AMD) jumped nearly +10%.

- Estée Lauder (+7.2%) and MGM Resorts (+6.6%) also performed exceptionally well.

Meanwhile, UnitedHealth, Salesforce, Johnson & Johnson, Merck, and McDonald’s fell by 1–2%, reflecting ongoing weakness in health care and consumer stocks.

4. Market Outlook: Caution amid Rising Volatility

While the major indices are bouncing back, volatility and uncertainty remain high. The risk of a further escalation in the Middle East or a policy surprise by the Fed could undermine these gains. We advise staying vigilant and employing diversification strategies to account for potential swings in market sentiment. Furthermore, rising bond yields — with the 10-year Treasury creeping toward 4.44–4.45% — reflect ongoing nervousness about the trajectory for interest rates.

5. Sector-Specific Insights

Some sectors are poised to outperform in this new climate:

- Technology and Artificial Intelligence companies continue to outperform due to strong forward guidance and ongoing innovations.

- Commodities and Energy stocks may ease if oil prices remain weak, reflecting reduced geopolitical stress.

- Healthcare stocks remain under pressure amid policy uncertainty and growing competition in their respective spaces.

6. Market Indicators to Watch This Week

We’re focusing closely on several key indicators this week:

✅ The Federal Reserve’s policy announcement and subsequent press conference with Chair Powell.

✅ The May US retail sales report (with a projected decline of -0.6% and +0.2% for the ex-autos number), which may illuminate the health of the US consumer and their ability to sustain strong spending in a high-interest-rate environment.

🔹 Investor Takeaway 🔹

While markets have rebounded and momentum is strong, we advise investors to remain cautious and vigilant. The ongoing policy signals, both from the Fed and from international geopolitical tensions, will guide the trajectory for US stocks in the days and weeks ahead.

We remain positive on high-caliber tech stocks, strong financial companies, and firms poised to outperform even in a challenging policy landscape. Furthermore, careful diversification across sectors, a keen understanding of policy signals, and a vigilant watch on forward indicators remain crucial for navigating whatever lies ahead.

🔹 Summary Highlights 🔹

- Dow Jones jumped +1.1%.

- S&P 500 rose +1.1%.

- Nasdaq Composite soared +1.3–1.6%.

- Brent Oil fell toward $71–$72 per barrel.

- 10-Year Treasury Yield stands near 4.44–4.45%.

- The Fed’s policy decision and May retail sales are key events for the markets this week.