AMD’s $10 Billion Stock Buyback: What It Means for Your Investments

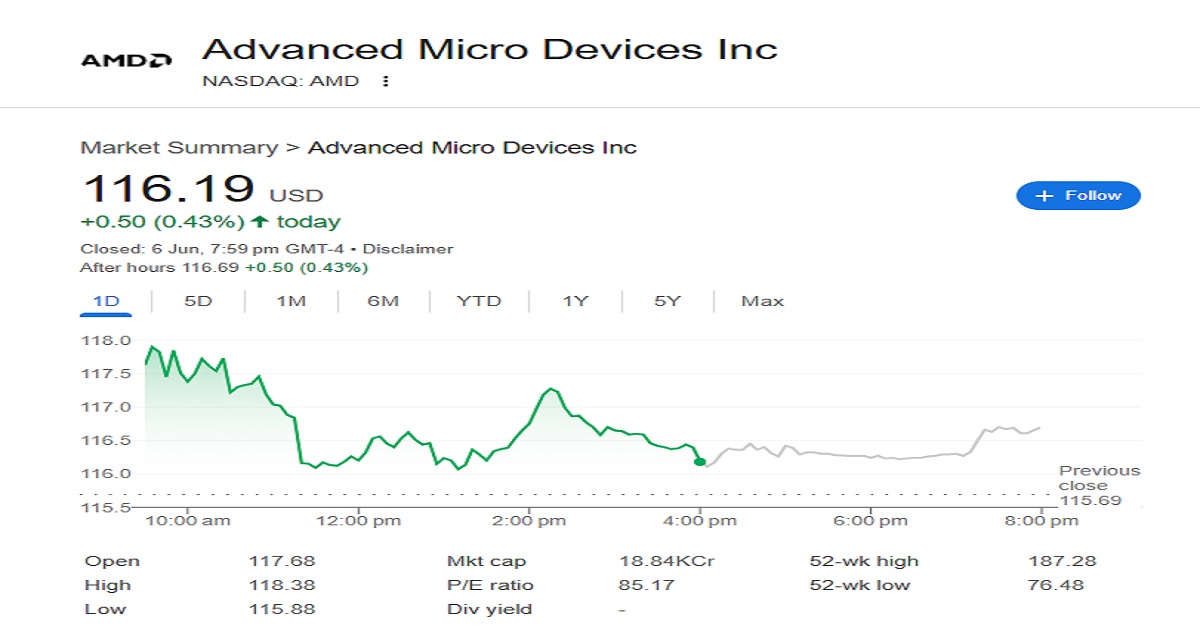

Let me tell you why I’ve been glued to my trading app all morning. AMD just dropped a bombshell – they’re buying back 10billionoftheirownstock.Assomeonewho′sbeenridingtheAMDrollercoastersince2018(rememberwhenitwasunder10billionoftheirownstock.Assomeonewho′sbeenridingtheAMDrollercoastersince2018(rememberwhenitwasunder20?), this news has me both excited and a little cautious.

Why This Matters to Everyday Investors Like Us

You don’t need to be a Wall Street whiz to understand why this is big news. Imagine if your local bakery suddenly announced they were buying back a bunch of their own cupcakes – you’d think they must really believe in their recipe, right? That’s essentially what AMD is doing here.

Three Reasons This Buyback Makes Sense

- They’re Putting Their Money Where Their Mouth Is

When companies buy back shares, it’s like the CEO saying “I’d rather own more of this company myself.” After AMD’s recent wins in AI chips and data centers, this feels like a confident move rather than desperation. - Your Shares Just Got a Tiny Bit More Valuable

Think of it like a pizza party where some guests don’t show up – suddenly there’s more pizza for everyone who came. Fewer shares outstanding means each remaining share represents a slightly bigger piece of AMD. - They’re Cleaning Up Their Employee Compensation

Tech companies love paying people with stock (I once knew an engineer who got paid entirely in Tesla shares – wild times). This buyback helps balance that out so existing shareholders don’t get diluted.

What This Means for Your Portfolio

Here’s where it gets interesting. The market clearly likes this news – shares jumped 5% in pre-market trading. But should you jump in now? Let me share what I’m seeing:

The Good

- Historical Precedent: When Apple did their $90B buyback in 2023, shares climbed 35% over the next year

- Analyst Love: Morgan Stanley just raised their price target to $220

- CEO Track Record: Lisa Su has been crushing it since she took over in 2014

The Not-So-Good

- Valuation Concerns: At 35 times earnings, this isn’t exactly a bargain bin stock

- Competition: Nvidia isn’t going to just hand over their AI crown

- Market Jitters: If the Fed changes course on rates, all tech stocks could wobble

My Personal Take (After Getting Burned in 2021)

I’ll be honest – I bought AMD at $160 in 2021 and had to sweat it out for months before breaking even. Here’s what I’ve learned:

- Long-term? Probably still a good hold if you believe in their AI and data center strategy

- Short-term? Might be smarter to wait for a pullback – these buyback pops often fade a bit

- New investor? Consider dollar-cost averaging rather than going all in now

The Bottom Line

AMD’s making a bold move here, and I respect that. But remember – no single announcement makes or breaks a stock. If you’re already in, this is encouraging news. If you’re thinking about buying, maybe watch how it handles this pop first.

What’s your take? Jumping in, holding tight, or waiting it out? Hit reply and let’s chat – I read every response!

P.S. If you found this helpful, forward it to a friend who’s into investing. Good info should be shared!