Gold has been a timeless symbol of wealth, investment, and tradition in India. But have you ever wondered how the price of gold is decided? It’s not just about international markets—many local factors come into play as well. Here’s a simplified breakdown to help you understand what really drives gold prices in India.

🔑 Key Factors That Decide Gold Price

- Global Market Trends

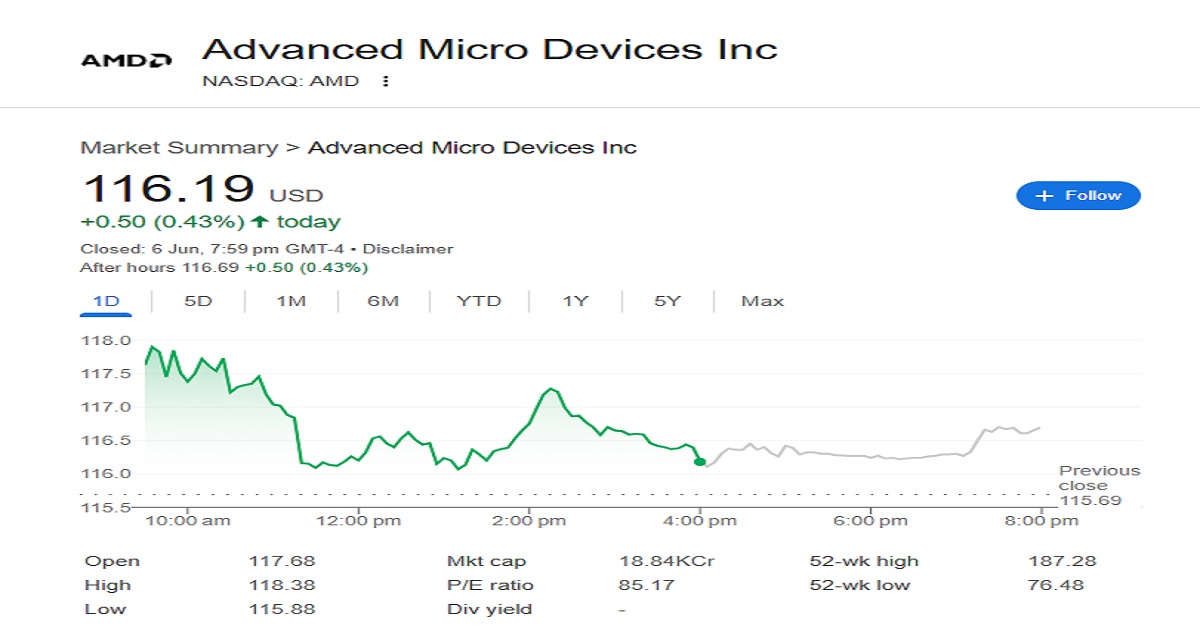

Gold prices are first influenced by the London Bullion Market and COMEX (US-based commodity exchange). These set the benchmark “spot price” of gold in USD daily [6]. - US Dollar vs. Indian Rupee

Since India imports most of its gold, a weaker rupee makes gold more expensive. Currency fluctuations have a direct impact on the final price [4]. - Import Duty & GST

The government imposes 12.5% customs duty and 3% GST, adding a significant markup over global rates [1]. - Demand and Supply in India

High demand during festivals and weddings pushes prices up. Limited supply can further drive costs higher [3]. - Interest Rates and Inflation

Lower interest rates and rising inflation often lead investors to shift to gold as a safe-haven asset [2].

📍 Where to Check Latest Gold Rates?

You can find updated gold rates on:

- Indian Bullion & Jewellers Association (IBJA)

- Multi Commodity Exchange (MCX)

- Financial platforms and apps

Conclusion:

Understanding the factors behind gold pricing can help you make smarter investment or purchase decisions. Track both global benchmarks and Indian market conditions to know when it’s the right time to buy.